Is There Nj Sales Tax On Labor . Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Municipal governments in new jersey are also. Are you selling taxable goods or services to new jersey residents? Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Do you have nexus in new jersey? Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. Are your buyers required to pay.

from www.templateroller.com

New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Municipal governments in new jersey are also. Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. Do you have nexus in new jersey? Are you selling taxable goods or services to new jersey residents? Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Are your buyers required to pay.

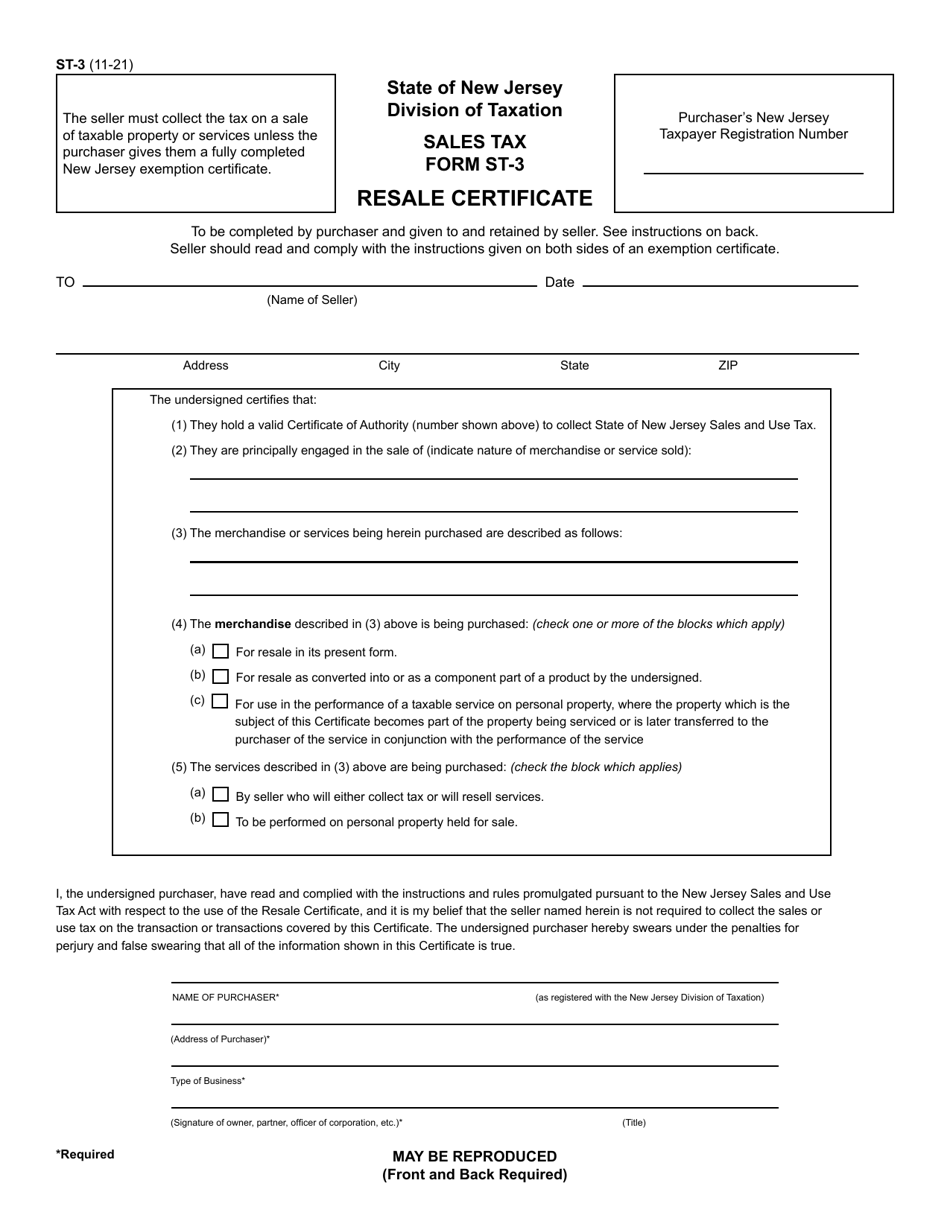

Form ST3 Download Printable PDF or Fill Online Resale Certificate New

Is There Nj Sales Tax On Labor Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Municipal governments in new jersey are also. Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. Are your buyers required to pay. Do you have nexus in new jersey? Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Are you selling taxable goods or services to new jersey residents? New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966.

From davida.davivienda.com

7 25 Sales Tax Chart Printable Printable Word Searches Is There Nj Sales Tax On Labor Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Do you have nexus in new jersey? Municipal governments in new jersey are also. Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. New jersey has a. Is There Nj Sales Tax On Labor.

From www.exemptform.com

New Jersey Sales Tax Exemption Form St 5 Is There Nj Sales Tax On Labor Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Do you. Is There Nj Sales Tax On Labor.

From jemiebmiriam.pages.dev

New Jersey State Tax Rate 2024 Hana Quinta Is There Nj Sales Tax On Labor Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Are you. Is There Nj Sales Tax On Labor.

From templatesowl.com

Blank Nj Sales Tax Online St 50 Fill Out and Print PDFs Is There Nj Sales Tax On Labor Are your buyers required to pay. Are you selling taxable goods or services to new jersey residents? Municipal governments in new jersey are also. New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625%. Is There Nj Sales Tax On Labor.

From www.parklaneresorts.com

Reservations Is There Nj Sales Tax On Labor Do you have nexus in new jersey? Are you selling taxable goods or services to new jersey residents? Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. Are your buyers required to pay. Because the economy has shifted over time from a manufacturing economy to a service. Is There Nj Sales Tax On Labor.

From forixcommerce.com

How to Interpret New Jersey Online Sales Tax Rules Forix Is There Nj Sales Tax On Labor Municipal governments in new jersey are also. Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. Are you selling taxable goods or services to new jersey residents? Do you have nexus in new jersey? Are your buyers required to pay. New jersey has a statewide sales tax rate. Is There Nj Sales Tax On Labor.

From michaeljgoodxo.blob.core.windows.net

Does New Jersey Have Online Sales Tax Is There Nj Sales Tax On Labor Are your buyers required to pay. Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. Municipal governments in new jersey are also. Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Contractors working in new jersey. Is There Nj Sales Tax On Labor.

From www.nj.com

Done with taxes? Nope. Here's what you need to know now for your 2018 Is There Nj Sales Tax On Labor Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. Do you have nexus in new jersey? Municipal governments in new jersey are also. New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Contractors working in new jersey are required. Is There Nj Sales Tax On Labor.

From formspal.com

Nj Sales Tax Online St 50 ≡ Fill Out Printable PDF Forms Online Is There Nj Sales Tax On Labor Are your buyers required to pay. Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Municipal governments in new jersey are also. Because the economy has shifted over time from a. Is There Nj Sales Tax On Labor.

From linpernille.com

Collecting NJ Sales Tax as a Photographer Lin Pernille Is There Nj Sales Tax On Labor Do you have nexus in new jersey? Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Are you selling taxable goods or services to new jersey residents?. Is There Nj Sales Tax On Labor.

From www.concordehotels.com.tr

jersey tax rate,OFF Is There Nj Sales Tax On Labor Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Are your buyers required to pay. Are you selling taxable goods or services to new jersey residents? Municipal governments in new. Is There Nj Sales Tax On Labor.

From krscpas.com

2017 NJ Tax Changes Business Owners Need to Know KRS CPAs, LLC Is There Nj Sales Tax On Labor Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Are your. Is There Nj Sales Tax On Labor.

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny Is There Nj Sales Tax On Labor Do you have nexus in new jersey? Are your buyers required to pay. Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. Municipal governments in new jersey are also. Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625%. Is There Nj Sales Tax On Labor.

From russellrgephartxo.blob.core.windows.net

What Are The Tax Brackets In 2021 Is There Nj Sales Tax On Labor Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Do you have nexus in new jersey? Are your buyers required to pay. Are you selling taxable goods or services to new jersey residents? Municipal governments in new jersey are also. New jersey has a statewide sales tax rate of. Is There Nj Sales Tax On Labor.

From www.slideserve.com

PPT Contracts, Procurement, and Risk Management (CPRM) PowerPoint Is There Nj Sales Tax On Labor New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. Municipal governments. Is There Nj Sales Tax On Labor.

From taxedright.com

New Jersey State Taxes Taxed Right Is There Nj Sales Tax On Labor Are your buyers required to pay. Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Municipal governments in new jersey are also. Unless a sale is exempted/excluded by the sales and use tax act, new jersey imposes a tax of 6.625% upon the receipts. Do you have nexus in. Is There Nj Sales Tax On Labor.

From www.youtube.com

NJ Resale Certificate & Tax Registration Nasıl Yapılır? Farkları Is There Nj Sales Tax On Labor Are you selling taxable goods or services to new jersey residents? Municipal governments in new jersey are also. Contractors working in new jersey are required to be registered with the state for tax purposes and to collect new jersey. Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Are. Is There Nj Sales Tax On Labor.

From www.njpp.org

Millions of New Jerseyans Deduct Billions in State and Local Taxes Each Is There Nj Sales Tax On Labor Because the economy has shifted over time from a manufacturing economy to a service economy, states are now looking to. Are you selling taxable goods or services to new jersey residents? New jersey has a statewide sales tax rate of 6.625%, which has been in place since 1966. Are your buyers required to pay. Contractors working in new jersey are. Is There Nj Sales Tax On Labor.